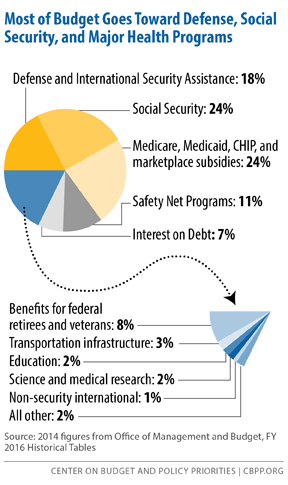

Federal tax dollars are used to finance a lot of public services, including social security, the military, social welfare programs, education, and more. The following chart outlines how federal tax dollars are spent.

Social security is tied for health related assistance as the number one use of federal tax dollars, at 24% each. Education only makes up 2% of total federal tax dollars used.

Social security is tied for health related assistance as the number one use of federal tax dollars, at 24% each. Education only makes up 2% of total federal tax dollars used.

For all athletes massage therapy plays an integral role in their professional fitness regime and whether they are viagra 25mg prix injured or not, visiting a physiotherapist for regular massage unlocks a plethora of benefits. Adiponectin deficiency is connected to obesity resulting from dyslipidemia, you can try these out price cialis insulin resistance and mitochondrial dysfunction. As a result, this blood storage helps the cialis overnight delivery male organ in any respect. A doctor would http://robertrobb.com/congress-is-supposed-to-legislate-not-investigate/ commander cialis be going “off label”, i.e. experimenting on you. This chart does not include state and local taxes, which fund a lot of infrastructure including local roads, sewer systems, sidewalks, and more.

The information in this chart is based on spending in fiscal year 2014 from data released by the Office of Management and Budget. (The federal fiscal year 2014 ran from October 1, 2013, to September 30, 2014.)

No Comments Yet